Please note: We specialize in technology camps, not tax preparation. We recommend that you speak with a tax professional before filing. The child and dependent care information above does not encompass any Flexible Spending Accounts your employer may have established at your company. Please check with your HR Department to find out if your company’s FSA plan covers day camps.

I know, I know…the subjects of fun summer camp and “funless” income tax preparation don’t exactly go together as well as toasted ‘mallow and graham.

But, as painful as taxes might be, there is some value here for anyone that sent a child to camp last summer, or is planning to in the coming months. Because let’s face it, camps cost money, and any chance you have to offset such costs is worth exploring, right?

Is Summer Camp Tax Deductible?

If you sent a child to summer camp, you might be able to take advantage of a tax break in the form of the Child and Dependent Care Credit. Under certain income restrictions, up to 35% of the expenses incurred for sending a qualified child under the age of 13 (or disabled dependent of any age) to summer day camp may qualify for the credit. You can use up to $3,000 of your expenses to calculate the credit for the care of one child, or up to $6,000 of the expenses for two or more.

Why does the credit exist?

The credit exists to help parents offset care expenses while they work (or look for work). So, if you read between the lines, the credit can also be applied to a babysitter, summer school, or daycare, as well as summer day camp.

Details, Please?

In the above explanation of the credit, it’s important to note the many uses of “might,” “maybe,” “up to,” “restrictions,” “qualified,” and other “soft” terms. Simply, we are talking taxes here, and nothing is black and white, unfortunately; there are many caveats and factors to consider.

So with that said, I can sit here for hours and tell you every single thing I know about how you can qualify for the credit, but let’s face it, taxes are one of those things where you don’t really want to “take my word for it.” I get it!

So, please consult with a qualified tax professional for concrete specifics.

Until then, here is a nice summary video from TurboTax, along with a few main points the IRS and TurboTax touch on - and thus, points you’ll want to research - supplemented with a few personal words for the sake of clarity.

Expert Points on Summer Camp Tax Breaks

First, what is the difference between a tax credit and tax deduction?

Both are good, but a deduction only reduces how much taxable income you claim, while a credit directly reduces the amount of the tax liability owed (more here). With this topic, we are focusing on the credit opportunity, or, valuable “dollar for dollar” reductions.

Does summer camp count as dependent care?

Yes, summer day camp counts as dependent care. The same goes for preschool programs and similar pre-kindergarten care situations.

Is overnight summer camp tax deductible?

The use of the term “day camp” here is significant, meaning, there is a difference between day camp and overnight camp, and overnight camp expenses don’t qualify for the credit. Reason being, the cost of overnight camp isn’t considered work-related (like day camp), and thus not applicable. Here it is from the IRS.

So, then, does something like sports camp qualify?

The good news? There are a number of different types of summer camps, and "day camp" can usually mean anything from computer camp to chess camp and other highly-specialized summer programs. Again, as long as the main purpose of the camp is to provide “daycare” while you are working (or looking for work).

Can you tell me more about the type of care that qualifies? You mentioned camps, and also daycare and even babysitters?

Plus, it actually goes beyond that. According to TurboTax, money spent on babysitters, cooks, or even housekeepers who provide child care can count towards qualifying expenses.

The important thing to remember is that the care must be connected to the objective of allowing you to work, so babysitting or any other care arranged for personal reasons can’t be taken into consideration.

What if I’m a stay-at-home-parent caring for my child?

Sorry, there had to be some bad news in here somewhere! What does it mean? Basically, stay-at-home-parents and those who are unemployed (and not looking for work) are ineligible for the credit. The expenses incurred must be “work-related” to qualify (with “work-related” meaning the expenses allow you to work or look for work).

Again, the credit was established so working parents (or those looking for work) can have their children cared for during the day. If parents are home, it eliminates the need for care during the day (so says the IRS), and eliminates any “daycare” expenses. Here is another breakdown from TurboTax, answering a similar question.

Can you explain the bit on the maximum allowable credit limits?

You may qualify for a credit of up to 35% of qualifying expenses up to $3,000 for one child. If you have two or more children, the credit can be 35% of qualifying expenses up to $6,000. Wait, math? Sorry!

To break it down, 35% of $3,000 is $1,050, which is the maximum credit for one child. That said, the 35% does decrease in relation to adjusted gross income, reaching a minimum of 20% in most instances. So, count on something in the range of 20-35%. Here is another explanation from taxact.com.

Forms Needed for Summer Camp Tax Breaks

- A federal form 2441 must be attached to form 1040, 1040A, or 1040NR (No “EZ” returns).

- Child name and social security number must be presented on your forms.

- Lost deposits from enrolling a child in camp and canceling won’t qualify.

- Whomever you are paying for care must be identified with a taxpayer identification number. (Our # here.)

- You must have earned income for the year (along with your spouse, if filing jointly).

- If the amount owed in taxes is less than your credit, you can only zero out your bill.

Deducting Camp: Additional Resources

Here are some additional resources for you to consult regarding camp tax deductions and credits:

- IRS Can Help You Look After the Kids

- Deducting Summer Camps and Daycare with the Child and Dependent Care Credit

- Child and Dependent Care Expenses

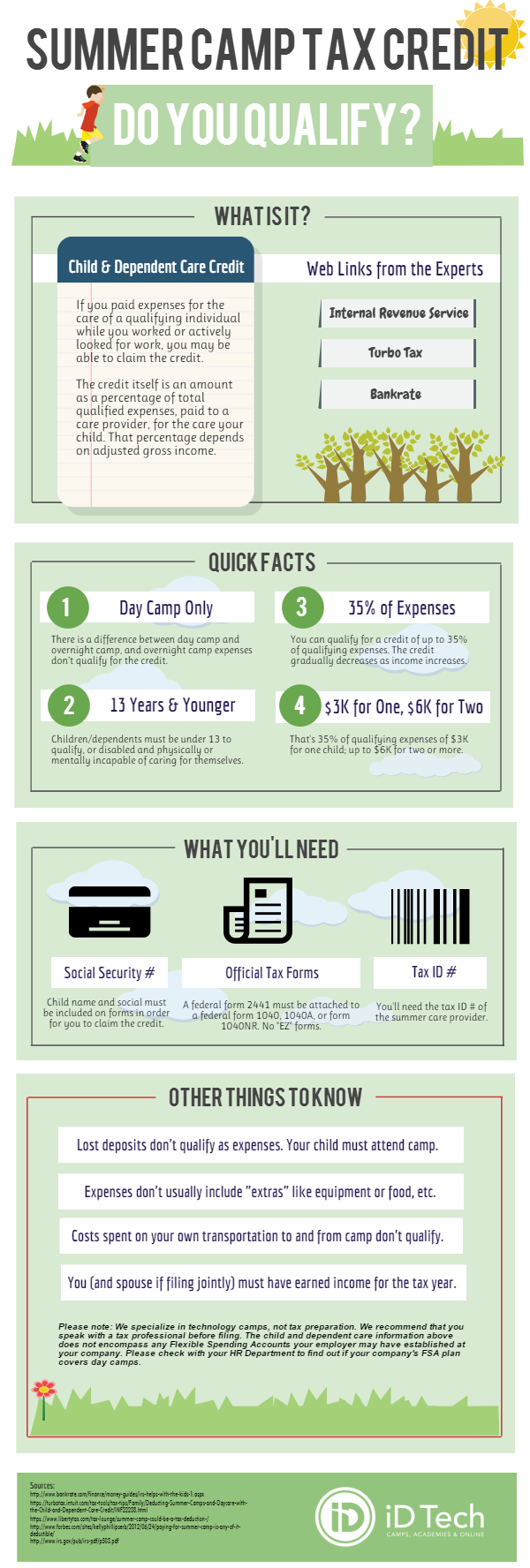

Last, you can review everything we just went over in a more easily-digestible manner. Feel free to take a look at the summer camp tax credit infographic below.

Please note: We specialize in technology camps, not tax preparation. We recommend that you speak with a tax professional before filing. The child and dependent care information above does not encompass any Flexible Spending Accounts your employer may have established at your company. Please check with your HR Department to find out if your company’s FSA plan covers day camps.